FedCash® E-Manifest Service

Now is the time to bring cash supply chain logistics up to speed.

The Federal Reserve has successfully piloted the E-Manifest Service, leveraging API technology, for currency deposits and orders beginning February 2023, and onboarded financial institutions and their servicing armored carriers across the country as early adopters.

The E-Manifest ServiceFootnote 1 is available to all financial institution customers of the Federal Reserve Banks and their servicing armored carriers, with no fees from the Fed to use this service. With the E-Manifest Service, armored carriers, on behalf of their financial institution customers, can share and receive electronic information in real-time. The Fed is dedicated to working with you to increase adoption of E-Manifest and bring greater transparency and efficiency to the United States cash supply chain. Learn about the industry leaders committed to GS1 Standards for Cash Visibility (Off-site, PDF).

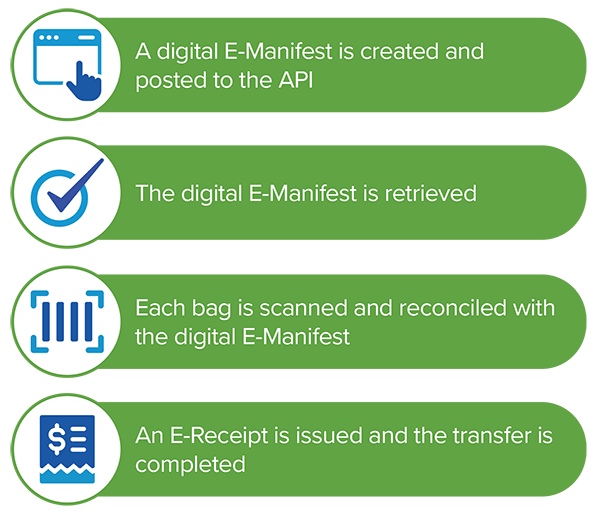

How does the E-Manifest Service work?

- A digital E-Manifest is created and posted to the API

- The digital E-Manifest is retrieved

- Each bag is scanned and reconciled with the digital E-Manifest

- An E-Receipt is issued and the transfer is completed

Take the next step to modernize the United States cash supply chain.

In support of financial industry standards, the E-Manifest Service utilizes the GS1 US license (Off-site). Take the first step to learn more about GS1 Standards and adopt the E-Manifest Service by completing the expression of interest form below. Regardless of where you are in your Cash Visibility journey, the Fed’s E-Manifest Readiness Program team will review your organization’s information and then connect with you to experience the benefits of this digitalization.

Hear from E-Manifest Service users

Explore customer testimonials to learn how the E-Manifest service has helped improve the efficiency and data sharing capabilities of participating financial institutions and armored carriers.

- Davis Bancorp Video Testimonial (Off-site)

- Nuvision Federal Credit Union Video Testimonial (Off-site)

- BankNorth Video Testimonial (Off-site)

- AXIOM Armored Video Testimonial (Off-site)

- US Bank Article: Bringing ‘Cash Visibility’ to money movement from armored carriers to customers (Off-site)

- Loomis Article: How a new industry partnership is improving transparency for cash transportation (Off-site)

Experience the benefits of digitalization

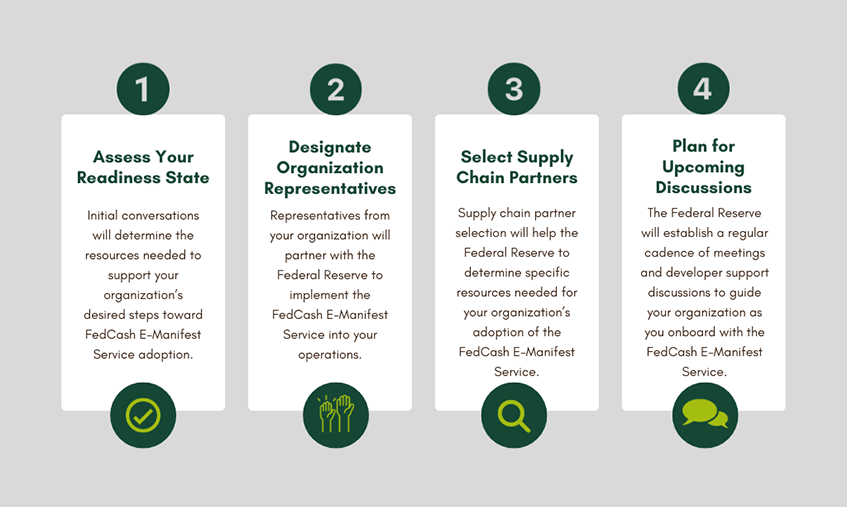

The Federal Reserve’s E-Manifest Readiness Program team is dedicated to helping the industry adopt the E-Manifest Service. After completing the expression of interest form, we will connect with your organization’s representative on the below next steps.

- Assess Your Readiness State

- Initial conversations will determine the resources needed to support your organization's desired steps toward FedCash E-Manifest Service adoption.

- Designate Organization Representatives

- Representatives from your organization will partner with the Federal Reserve to implement the FedCash E-Manifest Service into your operations.

- Select Supply Chain Partners

- Supply chain partner selection will help the Federal Reserve to determine specific resources needed for your organization's adoption of the FedCash E-Manifest Service.

- Plan for Upcoming Discussions

- The Federal Reserve will establish a regular cadence of meetings and developer support discussions to guide your organization as you onboard with the FedCash E-Manifest Service

Have questions about the E-Manifest Service? Contact the Federal Reserve at CVIndustry@frb.org.

Additional Resources

- Cash Visibility Marketing sheet (PDF)

- Cash Visibility Frequently Asked Questions

- Deposit Visual Reference Guide (PDF)

- FedCash Services Forms

- Dock experience for ACs (PDF)

- Cash Visibility Statement of Support (Off-site, PDF)

Footnote

1 There are no fees from the Federal Reserve to use the FedCash E-Manifest Service. There may be other associated costs for the adopting organization to implement the service.