Why we write so many checks and how instant payments could change that

In the United States we write billions of checks a year. But when was the last time you saw anyone write one at the checkout counter? And millennials and members of Gen Z often say they don’t even have any on hand. So, who’s writing all these checks, and why?

While it might boil down to habit for some check-writers, it’s likely that checks still meet the needs of certain payment scenarios (or “use cases”) better than the alternatives. This article looks at one particular use case (bill payments by consumers and businesses) where checks remain popular and suggests why instant payments might offer a good digital alternative.

Checks by the numbers

According to the most recent Federal Reserve Payments Study (Off-site), all core retail payment options, except checks, saw a significant increase in annual growth rates between 2015 and 2018. Checks, in contrast, declined at a compound annual rate of more than 7 percent.1 And over the past two decades, check volume has declined by almost two-thirds, from nearly 43 billion annually to 14.5 billion.

In addition, the Federal Reserve Bank of Atlanta’s Check Sample Survey (CSS) tells us that in 2018, a plurality of checks (40 percent) involved a payment from a consumer to a business (C2B), and 26 percent involved a payment from a business to another business (B2B). In total, then, businesses received two-thirds of all checks written.

Checks are used mainly for bill payments

More than 90 percent of the checks paid to businesses were for bills. Bill payments can include regularly recurring payments, such as rent, loan and utility bill payments, as well as nonrecurring payments for a wide variety of medical, educational, financial or personal services, donations, and materials and supplies to run businesses. As reported by Atlanta Fed Economist Oz Shy (Off-site), not all businesses are alike when it comes to receiving checks; instead, certain categories of businesses receive a particularly large share of their payments from their consumer customers via check, including, for example, contractors, landlords, charitable organizations and governments.2 Moreover, when consumers use a bill pay service to initiate their bill payments electronically, a small/midsize business often ends up receiving a check from the bill pay service because the business is not in the bill pay service’s account directory, or may not even accept electronic payments.

Using checks can be a relatively easy way to pay bills. For one thing, the payer doesn’t need to know their vendor’s financial institution account number, as would be required to send an ACH payment. In addition, many small businesses use accounting software that facilitates the creation of checks for payables. And according to Shy, small businesses often prefer checks partly as a way to avoid card processing fees.

Hidden costs?

Checks can be expensive in ways that may not be directly accounted for, however. For payers, there is the cost of the check itself, as well as the cost of sending it, and due to the variability in the timing of the mail, clearing and posting processes for check transactions, there is also the risk of a delay that can lead to late-payment penalties or delayed release of needed materials and supplies. What’s more, because it’s not easy to find out when the check was received and credited, payers can be left wondering whether their payment was timely or not. In addition, for business payers, there is the labor required to enter mailed or emailed invoices into their accounting software and then to authorize the creation of a check.

For payees, the cost of handling checks is significant because checks typically require a higher level of manual handling. And while larger businesses have been able to mitigate these costs to some extent, they do so primarily by paying for a lockbox service to streamline check handling and transmit accounting files. In any event, if invoice details aren’t included with the payment, there is greater potential for costly errors in posting. There’s also the risk of a check being returned for insufficient funds or other reasons, which can result in a loss, or at the least, a labor-intensive resolution effort.

Instant payments could be the right alternative

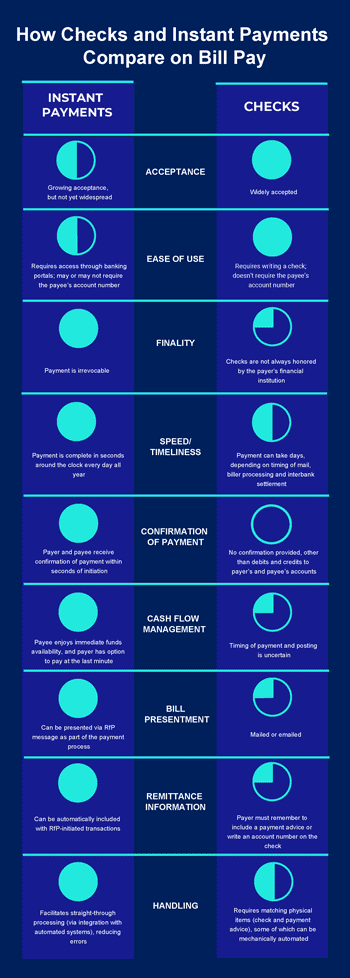

While checks may meet certain bill payment needs that are not well served by traditional alternatives, use could decline even further as billers and bill payers learn how instant payments can address some of the disadvantages of checks.

Instant payments offer immediate and certain payment – a benefit to billers and their customers alike. For the biller’s customer, the ability to make a payment and receive confirmation of its acceptance in seconds is particularly beneficial in avoiding late payment penalties that can arise with the variability in timing/posting associated with check payments. Moreover, the risk of being caught short when the check clears (and being hit with NSF fees) is eliminated with instant payments because the payment is debited at the time it is authorized. By design, moreover, an instant payment typically can’t overdraw a payer’s account because the payer’s financial institution makes certain there are sufficient funds in the account before releasing the payment.3 In addition, the payer is able to wait until the payment is due to initiate the payment and can then receive immediate confirmation that the payment was accepted. However, because instant payments are irrevocable, payers should take care to ensure they are sending the payment to the intended recipient.

For the biller, the payment is reflected in their account within seconds of when their customer authorizes the payment, and the funds are immediately available – unlike checks, where the biller must wait for the check to clear before using the funds. And because instant payments are irrevocable, there is no risk of the payment being reversed for insufficient funds in the payer’s account.

Another key benefit for businesses generally is that they can use the instant payment system to send and receive invoices. This “request for payment” (RfP) feature enables businesses to integrate instant payments into their Accounts Payable and Accounts Receivable systems and automate the reconciliation of these payments. Doing so reduces errors and exception item handling. Billers benefit because they can automatically credit the correct customer account when they receive the payment. And their business customers benefit because they receive invoice details that can be automatically uploaded into their payables system for processing.

So, with all these advantages, what’s holding instant payments adoption back? For one thing, most businesses and consumers are not yet familiar with this new form of payment, and many financial institutions are still in the very early adoption phase. But once the capability is set up in payers’ and payees’ financial institutions’ portals, instant payments offer the flexibility of checks for bill payments, but with greater speed, finality and certainty. And unlike checks, they have the potential to more easily integrate into automated accounting systems and thereby reduce handling costs. With these advantages, it’s time to look into using instant payments for bill payments.

Read the bill pay use case (PDF) to learn how the Federal Reserve’s upcoming FedNowSM Service will support the instant settlement of bill payments.

Footnotes

1In addition to checks, core retail payment options include automated clearing house (ACH) payments, credit cards, non-prepaid debit cards and prepaid debit cards.

2Shy’s article uses data from the 2019 Diary of Consumer Payment Choice (Off-site) (DCPC), which, among other things, provides insights into the bill payment scenarios in which consumers are most likely to write checks. Contractors, plumbers and electricians received nearly 50% of all their consumer customer payments via checks; charitable organizations, landlords and government tax authorities received a third or more of their payments from consumers via check, and educational institutions received a quarter of their payments this way.

3Instant payments are typically “push payments” in that the payer “pushes” the funds to the payee, as opposed to sending an authorization for the payee to “pull” payments from the payer’s account. As part of a push payment, the payer’s financial institution makes a determination on whether to release the payment based on an automatic review of the payer’s available account balance.